Change Management and Organization Transformation

Change Management and Organization Transformation

VP & GM Emerson Electric – While overseeing Emerson Electric’s Business Portfolio, this assignment gave me the challenge and the opportunity to turnaround the company outlook for Brazil and capitalize on the investments made in that market.

Brazil continues to be one of the largest consumer markets, with very significant offshore oil and other commodity assets. This, in combination with a considerably developed portfolio of industries, makes it a vast source of opportunities. None of it, however, is without risk. That setting requires having both feet firmly planted on the ground and both eyes wide open, at all times.

Brazil, like other markets in Latin America, is a challenging environment: Precipitous economic fluctuations, uneven government policies, disproportionate regulations and the anachronism of many commercial rules, all paired with strong competition, make it convoluted.

In our case, less than effective internal processes and somewhat limited talent assets also added to the complexity. While having competent manufacturing facilities in Brazil, success requires continued streamlining of local capabilities, with strong cost, price, and management discipline.

Assignment Areas of Focus

Consolidating Operations:

Starting in 2012, Emerson made important capital investments in Brazil, consolidating operations in a single campus.

Starting in 2012, Emerson made important capital investments in Brazil, consolidating operations in a single campus.

Until then, Emerson’s operations were spread through five relatively small sites located in a 50 miles’ radius from the city of S. Paulo. In one of these locations (Sorocaba), we built a manufacturing, engineering, and administration park, investing over US$ 50 million. Given the matrix organization model, several aspects needed to be negotiated, agreed upon and adjusted to facilitate and execute the transition.

Until then, Emerson’s operations were spread through five relatively small sites located in a 50 miles’ radius from the city of S. Paulo. In one of these locations (Sorocaba), we built a manufacturing, engineering, and administration park, investing over US$ 50 million. Given the matrix organization model, several aspects needed to be negotiated, agreed upon and adjusted to facilitate and execute the transition.

The operations consolidation synergies needed also to be followed by a more efficient go to market strategy. Different business units, many times sharing the same customer base, used to behave like completely different companies, with inconsistent, sometimes misaligned practices.

Expanding the Scope of Corporate Services:

In little over a year, we revamped the Corporate Services Group, turning it from a hosting crew, into a wholly integrated shared services organization.

This project involved the consolidation of all administrative services related to Finance, IT, Payroll, Human Resources, EHS, Infrastructure, Facilities, Legal, Tax, and Compliance for eight different Business Units.

This project involved the consolidation of all administrative services related to Finance, IT, Payroll, Human Resources, EHS, Infrastructure, Facilities, Legal, Tax, and Compliance for eight different Business Units.

We accomplished this by becoming:

- A Platform for Profitable Growth: Uncovering opportunity areas to drive and support profitable growth. Becoming a plug & play resource to explore business opportunities.

- A Business Partner & Trusted Advisor: Understanding what is important to our customers. Discovering solutions for critical problems.

- An Efficiency Engine: Promoting and managing continuous improvement. Constantly measuring performance and communicating progress.

Rendering Services to Multiple Business Units in 40 Distinct Competences

15% YOY Cost Reductions | Over $3 Million Savings

Improvements, Cost Reductions, and Savings:

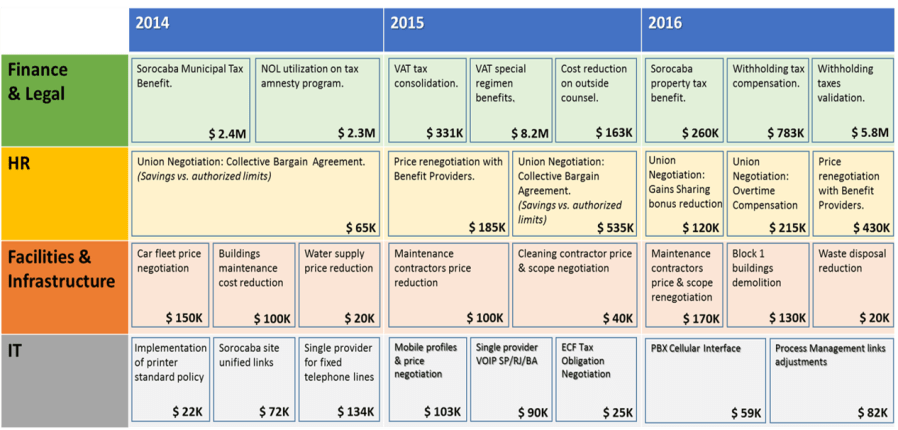

With a continuous improvement approach, during 2015 and 2016, several programs and projects were put in place, generating substantial results. The top 30 initiatives, shown below, yielded over $25 million in cost reductions and savings, touching all business units.

Highlights:

- Tax Management: Given the high complexity and volatility of the Brazilian tax environment, this was the area with the greatest potential. Accordingly, we formed a Tax Committee to work on 11 projects to pursue savings on municipal, state and federal taxes. Since the second half of 2014, 8 specific initiatives produced savings in excess of $ 20 million.

Other significant opportunities continue to be pursued by the tax committee. - Legal Entities: Complementing the tax management strategy and in face of daunting Government & Legal requirements (+70 tax reporting obligations per legal entity), we have considerably reduced complexity, through closing and consolidation of active and dormant legal entities. (from originally 13 in 2014 to 4 by the end of 2016)

- Human Resources: A more aggressive stance towards union negotiations produced important labor cost avoidances. That, in addition to benefits cost and price negotiation, led to about $1.5 million annual savings.

- Facilities, Infrastructure & IT: Several relatively small projects resulted in over $1.3 million in cost reduction and savings.

Adjusting to Business Conditions:

Towards the end of 2015, the combination of the changes on the Emerson portfolio, the galloping deterioration of the local economy, and the downfall of Brazil NOC-Petrobrás required acute adjustments:

- Divestiture of non-performing businesses.

- Business Units Spin-Off: Transition of allocated corporate resources to new P&L and legal entity.

- Detailed evaluation of the structure, roles and reporting lines of the remaining shared services employees.

- The transition of shared services management to the Business Unit with the larger footprint, while establishing an executive board to review campus level matters.